Trucking business operators know just how critical it is to keep their fleet of trucks maintained and to have emergency capital available for unforeseen expenses. Commercial trucks and trained drivers in the trucking industry are a financially intensive venture.

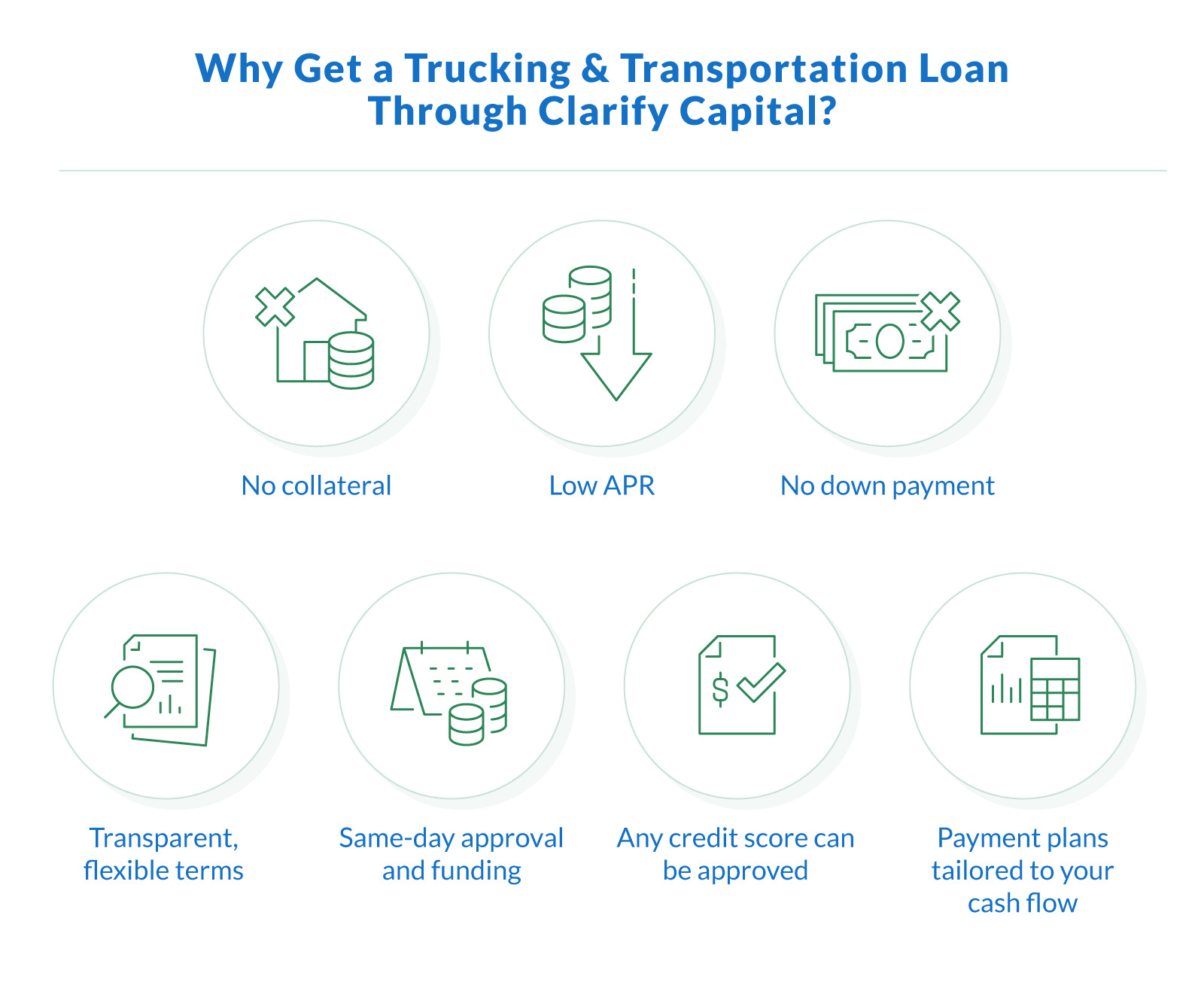

That's where transportation business loans from Clarify can help. Our network of over 75 lenders provides the money needed for all aspects of running a top-notch transport business on your terms.

Our mission is to help truckers pursue the American dream. Whether you have good or bad credit, we can provide business financing to withstand seasonal business expenses and trends, buy new trucks and logistics tools, maintain your fleet, and hire more trained drivers.

6 Best Business Loans for Trucking and Transportation

Having funded over 10,000 companies, we know that a traditional loan isn't for everyone. We've found the following six financing options to work best for small business owners in trucking and transportation. Our advisors will walk you through the pros and cons of each loan program to identify the best fit for your unique business needs.

1. Equipment Financing for Trucking Companies

An equipment loan is a great fit for transportation business owners seeking to buy or replace trucks and trailers. You can finance up to 100% of the cost of equipment leasing or buying. With competitive rates and minimal paperwork needed, you can secure business funding quickly. There are no prepayment penalties or collateral requirements apart from the vehicle itself. The structure of the financing is similar to that of consumer car loans.

2. Short-Term Loan for Trucking Companies

When you think of a small business loan in the traditional sense, you are thinking of a term loan. You borrow a fixed amount of money at a specific interest rate that you pay back based on the loan term length. You don't need any collateral or personal guarantee to get approved for a short-term loan. This type of financing is the most popular borrowing option for transport businesses.

3. Business Line of Credit for Trucking Companies

A business line of credit is a flexible funding option to have working capital always available when needed. Lines of credit have competitive interest rates and are structured similarly to a business credit card. You have a maximum limit from which you can withdraw funds and only pay interest on the amount of money you use.

4. B2B Invoice Financing for Trucking Companies

If you run a B2B commercial trucking business, you likely have outstanding invoices that are yet to be paid. Invoice financing, also called invoice factoring, allows you to get up to 100% of the invoice value from a lender as a lump sum payment. But what if your business is not B2B? In that case, we recommend equipment financing, term loans, or a business line of credit.

5. SBA Loans for Trucking Companies

The Small Business Administration provides financing backed in part by the agency. The two most popular SBA loan options are the 7(a) and microloan programs. Among all loans available for transportation companies, SBA 7(a) loans have the longest time to be approved. This is due to the massive amount of paperwork and credit score requirements by the SBA and its approved lenders and providers. If you need qualifications for an SBA loan, Clarify's advisors can help you streamline the application process.

6. Merchant Cash Advance

A merchant cash advance (MCA) is a flexible financing option designed to provide trucking companies with quick access to working capital. Unlike traditional loans, an MCA is structured around your future sales. You receive a lump sum of cash upfront and repay it through a percentage of your daily credit card transactions or bank deposits, making it ideal for businesses with fluctuating monthly revenue.

Types of Trucking Businesses We Work With

Trucking companies come in many forms, and each has unique financing needs. Clarify Capital helps a wide range of transportation businesses secure funding, including:

Long-haul freight carriers. Financing for cross-country fleets and OTR owner-operators.

Reefer and refrigerated transport. Loans to cover higher equipment costs and temperature-control systems.

Flatbed and heavy equipment haulers. Funding for specialized trailers and oversized loads.

Local delivery and courier services. Working capital for fuel, wages, and same-day delivery routes.

Auto transporters. Loans for car haulers and tow operators.

Dump truck and construction hauling. Equipment financing for commercial or municipal contracts.

Hotshot trucking. Capital for CDL and non-CDL drivers running urgent loads in smaller vehicles.

No matter your niche, we'll connect you with financing options tailored to your operation's size, seasonality, and cash flow.

Startup Trucking Loans: How New Businesses Can Qualify

Getting financing for a brand-new trucking company can be a challenge, but it's far from impossible. Many lenders, especially online lenders and alternative financing providers, offer loan options designed specifically for startups.

Here's how to improve your chances of approval if you're just starting out:

Show a solid business plan. Lenders want to see how you'll use the funds, your revenue projections, and a clear path to profitability. Highlight any contracts or partnerships you've lined up.

Have strong personal credit. In the absence of business credit, your personal credit score often serves as a key decision factor. Aim for a 600+ FICO score for the best loan options.

Put skin in the game. A down payment or collateral can boost lender confidence and help secure approval for new business loans or equipment financing.

Work with lenders familiar with startups. Traditional banks often require years in business. Online lenders, on the other hand, may work with companies that are less than six months old.

Clarify Capital helps startup trucking businesses access funding options even without an established financial history. We can match you with lenders who support new ventures.