Medical practice loans are for providers like doctors, dentists, and vets who want to grow or manage their business. Lenders often see health care professionals as strong borrowers because of steady income and long-term earning potential.

Finding the right loan takes time you don't have. That's why Clarify helps you compare offers in one place, without the stress. Our team works with you so you can choose what fits best and get back to running your practice.

It's also why we've created this guide to help you compare the best medical practice loans, understand your options, and apply with confidence.

What Are Medical Practice Loans?

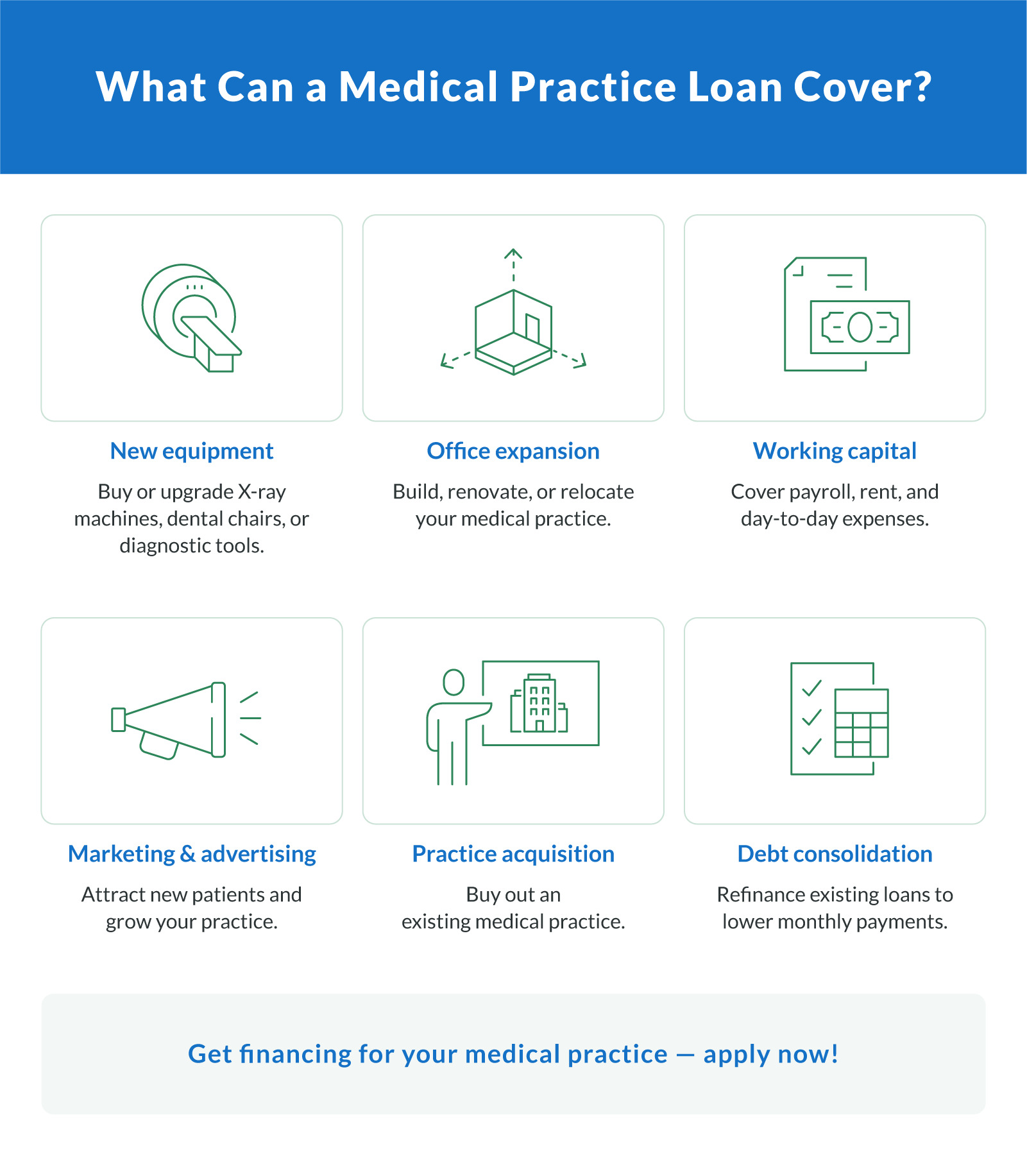

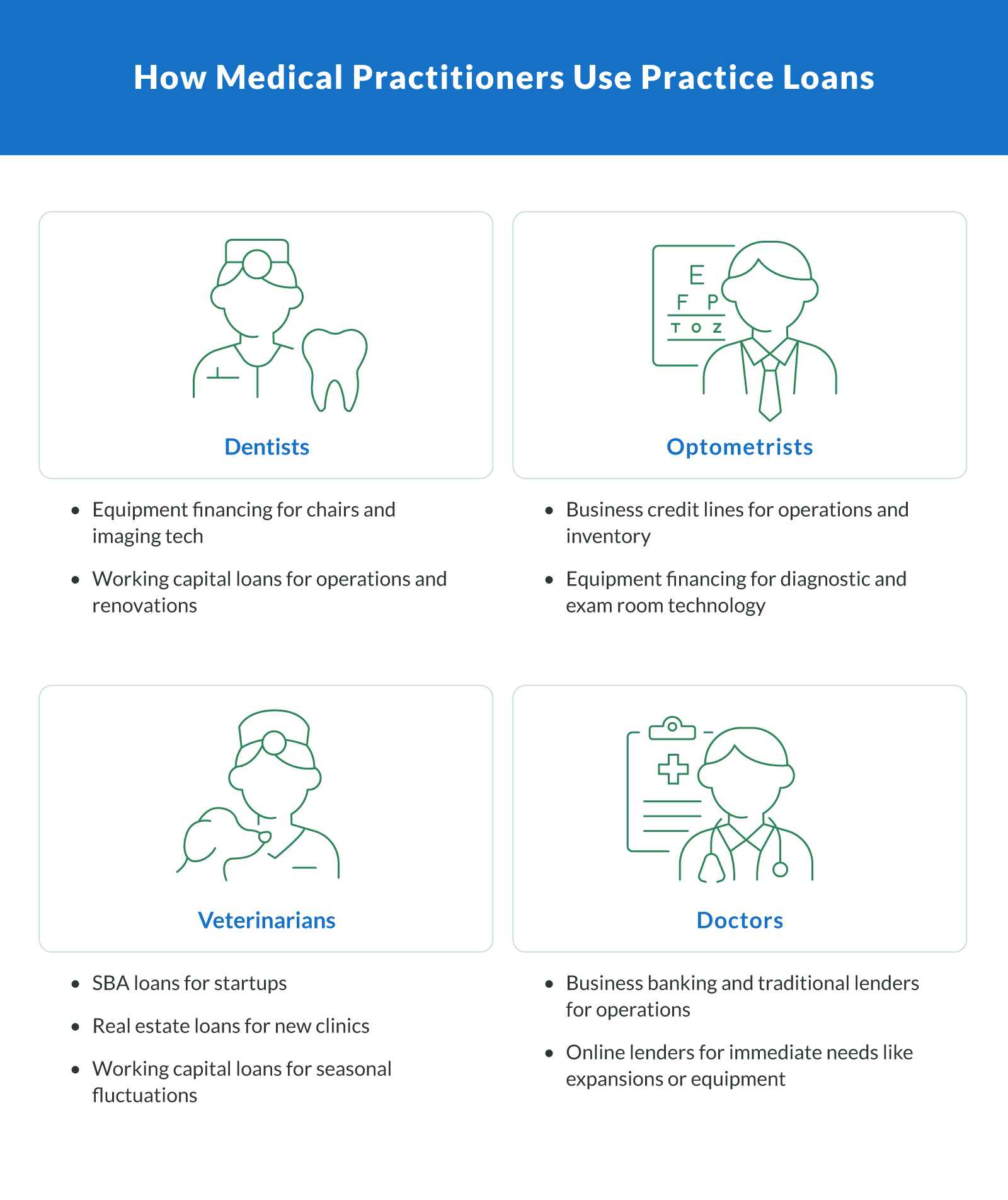

Medical practice loans are specialized business financing products designed for healthcare professionals, including doctors, dentists, veterinarians, and optometrists, who are starting, growing, or managing a private practice. These loans offer funding for everything from equipment purchases and office space renovations to payroll, working capital, and debt consolidation.

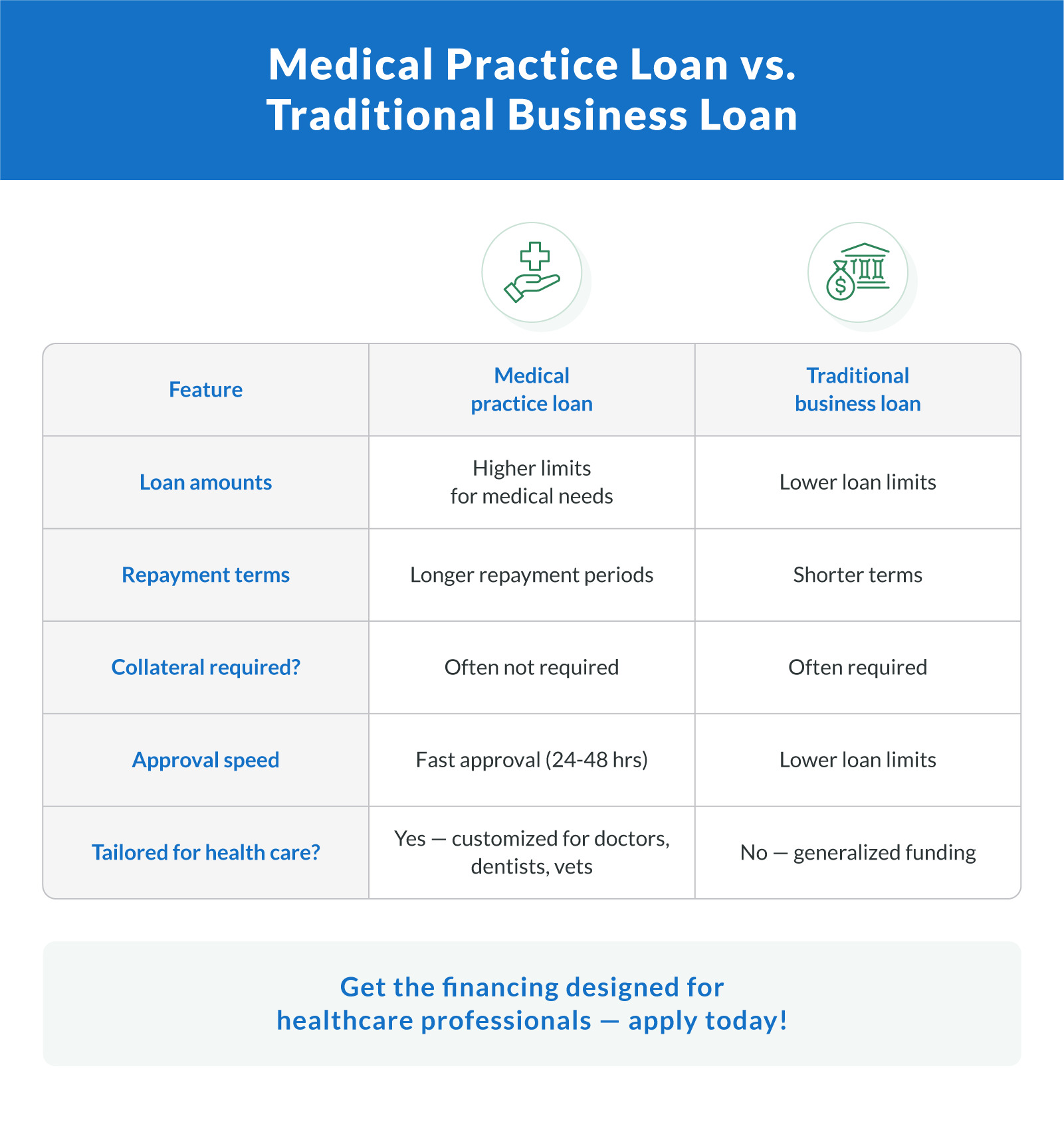

Unlike general small business loans, medical practice loans are tailored to the financial realities of running a healthcare practice. Many lenders view medical professionals as low-risk borrowers due to their steady income and long-term earning potential. As a result, medical practice financing often comes with higher loan amounts, more flexible repayment terms, and faster approval.

Whether you're launching a new clinic or expanding an existing medical office, these loans are built to support the unique needs of healthcare providers.

The 4 Best Medical Practice Loans for Doctors, Dentists, and Healthcare Providers

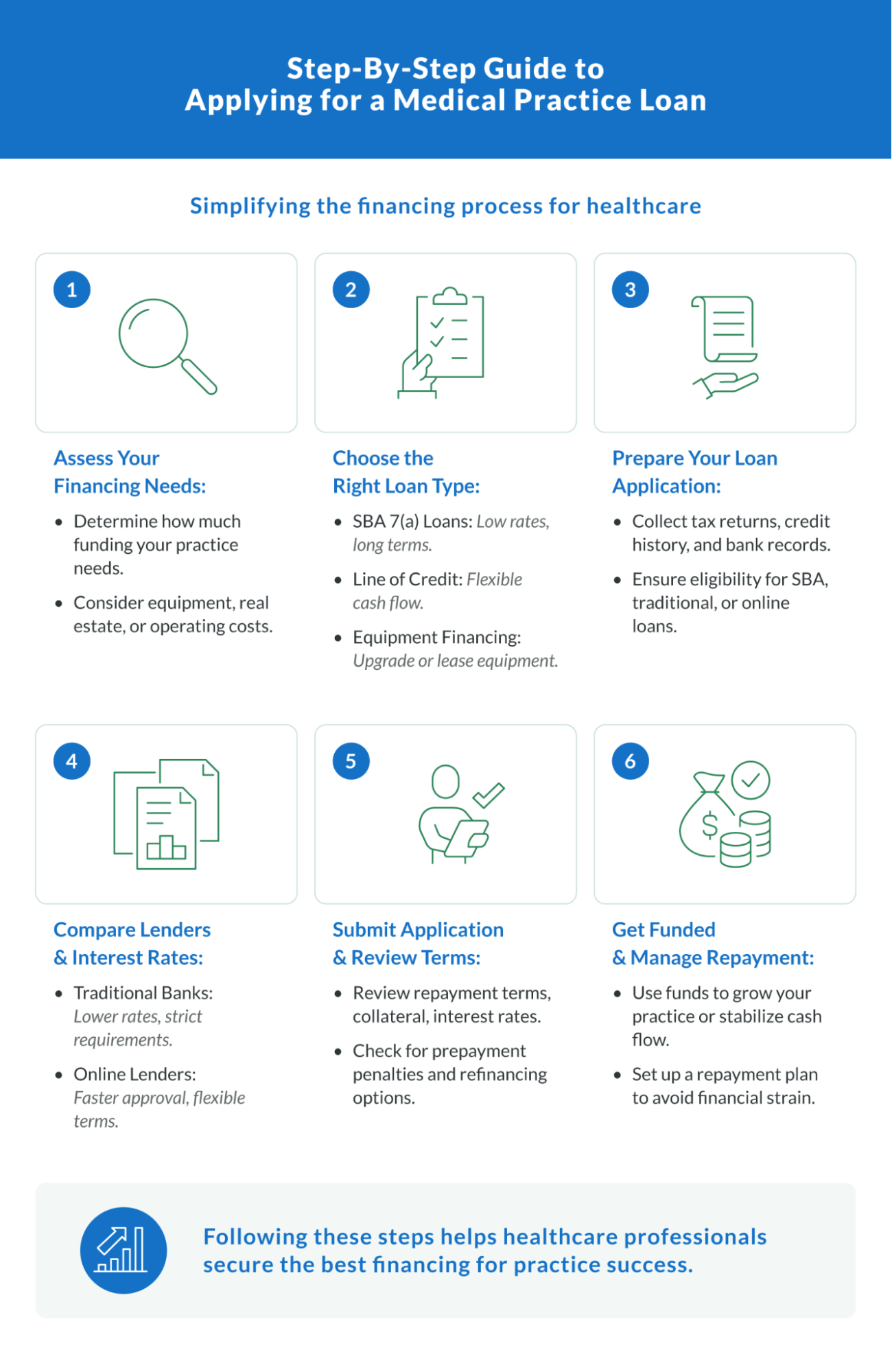

Let's look at the best financing options for health care professionals. When you apply for a loan through Clarify, your dedicated financial adviser will guide you through the process.

Term Loans for Doctors

When you think of business loans, you likely think of a term loan. A long- or short-term loan is structured like traditional financing from a bank. You borrow a specific amount of capital at a specified APR and repayment terms. The duration of the loan term can be flexible based on your cash flow needs.

Here are the key benefits of term loans for medical practices:

Fast access to capital. These loans provide immediate funding to meet urgent financing needs and help you address time-sensitive opportunities.

Quick approval process. Credit approval and funding typically take only 24 to 48 hours, getting you the capital you need without lengthy delays.

No collateral is required. Unsecured term loans don't require collateral or a personal guarantee, reducing your risk while maintaining flexibility.

Flexible credit requirements. Lenders often approve both good and bad credit scores, making this option widely accessible for medical professionals.

Business Line of Credit for Doctors

If you've ever had a home equity line of credit or used a business credit card, you already know the overall structure of a business line of credit. Lenders approve you for a maximum credit line, and you can withdraw funds as needed. You only pay interest on funds you use from the available credit line.

Here's why a line of credit might be right for your medical practice:

On-demand funding. You can withdraw funds as financial needs arise, offering the flexibility to manage varying expenses.

Pay for what you use. Interest is only charged on the amounts you withdraw, not your total credit limit, helping you control costs.

Build credit history. Using this credit responsibly can help improve your personal credit score over time, creating future financing opportunities.

Early payoff benefits. There's typically no prepayment penalty, allowing you to pay off the balance early without extra costs.

Medical Equipment Loans

Medical equipment is the foundation of a successful practice. Aging technology can hamper your ability to provide quality care. Whether you have new equipment purchases or are paying to repair existing ones, equipment financing can cover up to 100% of the costs. The structure of an equipment loan is similar to a car loan — the equipment, such as an X-ray machine, serves as collateral for the financing.

Here's what makes equipment loans an attractive option for medical practices:

Streamlined process. This financing option offers quick funding with minimal documentation required, simplifying the loan process.

Flexible credit requirements. Creditworthiness isn't necessary, as the equipment itself serves as collateral for the lender.

Competitive rates. These loans typically come with competitive interest rates, making them a cost-effective choice for your practice.

SBA 7(a) Loan for Doctors

In cases where your working capital needs are further out into the future, an SBA 7(a) loan can provide some of the best interest rates and terms. SBA loans are secured partly by the U.S. Small Business Administration (SBA). Your actual loan is through an SBA-approved lender. The federal agency guarantees up to 85% of loans under $150,000 and 75% of loans over $150,000.

Here are the main advantages of SBA 7(a) loans for medical practices:

Extended terms. These loans offer long payment terms, with loan lengths ranging from five to 25 years, providing payment flexibility.

Affordable rates. They typically come with good interest rates, making them an affordable financing option for your practice.

Government backing. The SBA guarantees either 75% or 85% of the total loan amount to the lender, depending on the amount borrowed, reducing their risk and improving your approval odds.

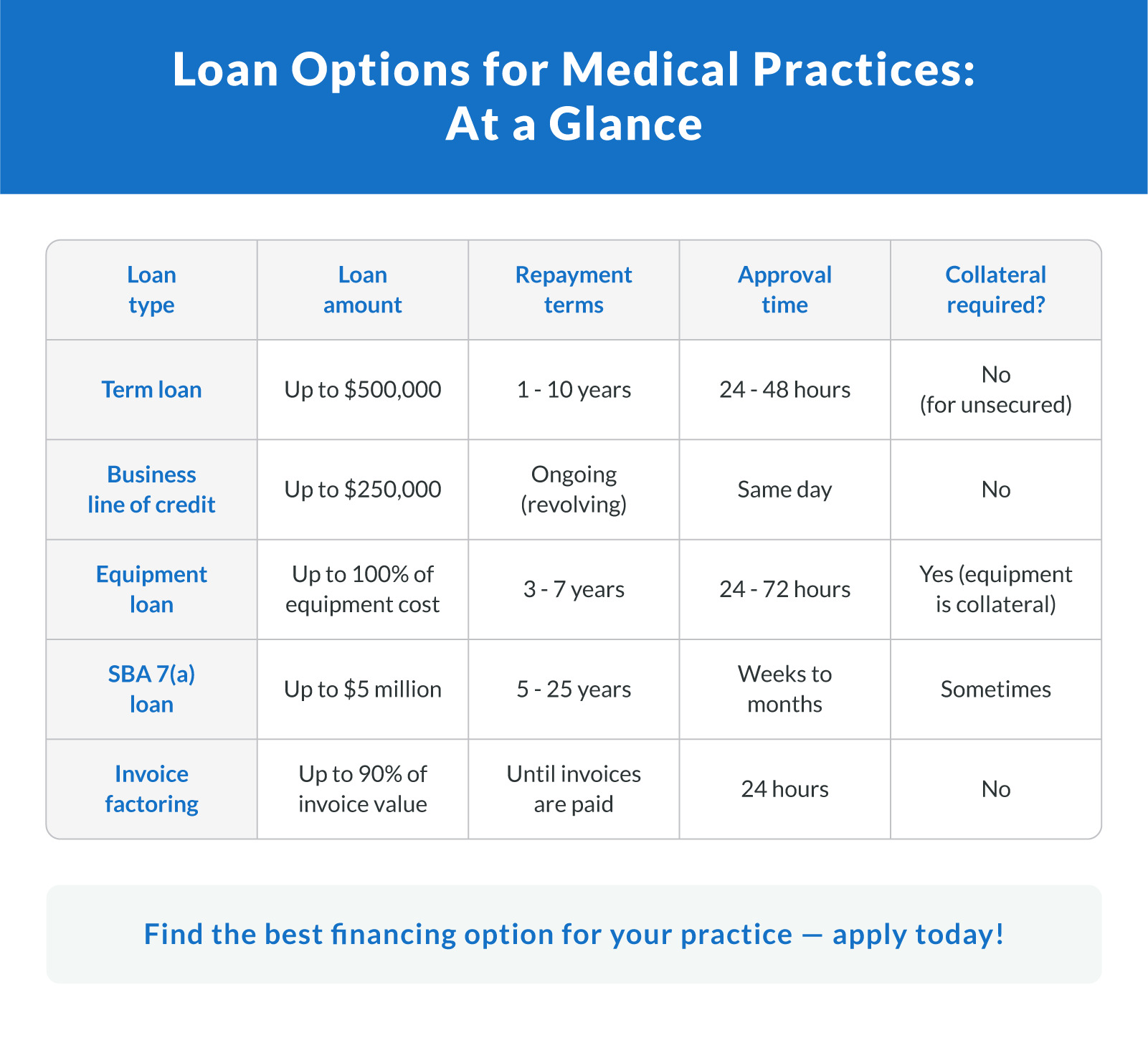

Loan Type Comparison

Use this side-by-side comparison to quickly evaluate different loan types and choose the best fit for your business needs and qualifications.

| Loan type | Best for | Loan amounts | Repayment terms | Collateral Required? |

|---|---|---|---|---|

| Term loan | Growth, renovations | $10K–$5M | 6–60 months | No |

| Line of credit | Managing cash flow | $5K–$250K | Revolving | Sometimes (usually no) |

| Equipment financing | Buying diagnostic or surgical tools | Up to 100% cost | Based on equipment life | Equipment only |

| SBA 7(a) | Large expansion or acquisition | $50K–$5M | 5–25 years | Sometimes |

| Merchant cash advance | Fast cash based on sales receipts | $5K–$500K | Varies | No |

Who Should Apply for a Medical Practice Loan?

Medical practice loans are a smart choice for healthcare professionals who need fast, flexible access to capital without the delays or restrictions of traditional financing. You may be a good candidate if:

You're starting your own practice. Whether you're opening a dental office, veterinary clinic, or medical spa, practice loans can fund launch costs like real estate, licensing, and staffing.

You're expanding your operations. Need a second location, more equipment, or additional exam rooms? A loan can help you scale without draining your reserves.

You're upgrading medical equipment. Equipment financing lets you invest in the latest technology without a large upfront payment.

You're navigating cash flow gaps. Lines of credit and working capital loans help you stay financially stable while waiting for insurance reimbursements.

You're buying or acquiring another practice. Use a loan to purchase an existing healthcare business, often with up to 100% financing available.

You're refinancing or consolidating debt. Lower your interest rate or simplify your monthly payments by refinancing existing business loans.

If you're a licensed medical professional with steady revenue or a strong business plan, there's likely a financing option that fits your goals, and Clarify Capital can help you find it.